July 14, 2022

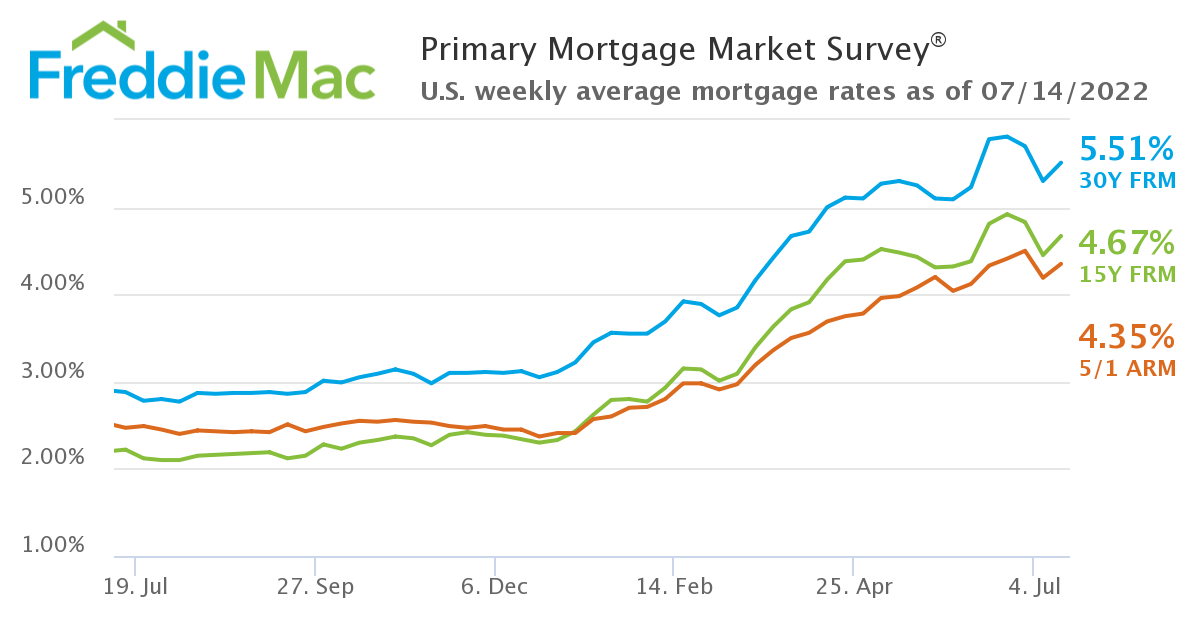

Mortgage rates are volatile as economic growth slows due to fiscal and monetary drags. With rates the highest in over a decade, home prices at escalated levels, and inflation continuing to impact consumers, affordability remains the main obstacle to homeownership for many Americans.

Do you have other real estate questions? Please contact me at your earliest convenience. I’d be glad to assist you or someone you know!

Sal Soriano, REALTOR

972.281.7500

AVERAGE COMMITMENT RATES SHOULD BE REPORTED ALONG WITH AVERAGE FEES AND POINTS TO REFLECT THE TOTAL UPFRONT COST OF OBTAINING THE MORTGAGE. VISIT THE FOLLOWING LINK FOR THE DEFINITIONS. BORROWERS MAY STILL PAY CLOSING COSTS WHICH ARE NOT INCLUDED IN THE SURVEY.

OPINIONS, ESTIMATES, FORECASTS, AND OTHER VIEWS CONTAINED IN THIS DOCUMENT ARE THOSE OF FREDDIE MAC’S ECONOMISTS AND OTHER RESEARCHERS, DO NOT NECESSARILY REPRESENT THE VIEWS OF FREDDIE MAC OR ITS MANAGEMENT, AND SHOULD NOT BE CONSTRUED AS INDICATING FREDDIE MAC’S BUSINESS PROSPECTS OR EXPECTED RESULTS. ALTHOUGH THE AUTHORS ATTEMPT TO PROVIDE RELIABLE, USEFUL INFORMATION, THEY DO NOT GUARANTEE THAT THE INFORMATION OR OTHER CONTENT IN THIS DOCUMENT IS ACCURATE, CURRENT OR SUITABLE FOR ANY PARTICULAR PURPOSE. ALL CONTENT IS SUBJECT TO CHANGE WITHOUT NOTICE. ALL CONTENT IS PROVIDED ON AN “AS IS” BASIS, WITH NO WARRANTIES OF ANY KIND WHATSOEVER. INFORMATION FROM THIS DOCUMENT MAY BE USED WITH PROPER ATTRIBUTION. ALTERATION OF THIS DOCUMENT OR ITS CONTENT IS STRICTLY

The Housing Boom that Won’t Go Bust